Alternative proteins are hot as a summer BBQ grill! Consumer adoption of alternative protein continues to grow for a variety of reasons – health, environment and animal welfare.

In Pearl’s 2019 Health & Wellness Study three-quarters (75%) of Canadians had either consumed or were interested in trying plant-based meat alternatives! Just under half of Canadians (43%) had consumed plant-based meat substitutes and will do so again, while one-third (32%) were interested in trying.

A few other data sources also point to the large and growing popularity of the alternative protein market.

- Euromonitor’s 2019 industry outlook estimates the global meat substitute market to be currently worth $19.5 billion globally.

- The Good Food Institute tracks sales of plant-based food, which is the largest source of alternative protein, increased 17% in 2018.

- The McKinsey 2018 dairy survey found that 82% of respondents rated plant protein as healthy, compared to 74% for animal protein.

While alternative protein options have been around for a long time, ingredient and technology innovation has improved the consumer experience, which in turn has sparked consumer interest and category growth. A wide range of alternative protein sources are being used such as plants, insects, fungi, and cultured tissues. Each protein alternative has its competitive advantages and its challenges. Below is a brief summary of the most popular alternative protein sources:

Plants

Plants are the most popular protein alternative. Soy and pea protein are the top plant protein options. Soy protein is neutral tasting, affordable, with very low environmental impact. However, being a GMO is a barrier to consumers who are concerned with food safety. Pea protein is also affordable with low environmental impact and advantage of being non-GMO. From a supply chain perspective, pea protein does have the shortcoming of creating a lot of starch by-product that requires finding use for it to remain economically viable. The popular brand Beyond Meat uses pea protein, while the Impossible Burger uses a soy-protein isolate.

Algae and seaweed are other plant-based protein options worth watching. There is also opportunity for plant-based protein sources to work together. For example, Triton Algae Innovations has identified a strain of non-GMO algae that when applied to plant based meat products helps it taste, smell, and cook more like an animal based burger.

Insects

Crickets are the most common source of plant protein in North America. Their environmental impact is very low and they are very efficient at converting feed to edible weight. The challenges faced by insect protein are low consumer acceptance and its higher cost versus animal protein.

Fungi

Mycoprotein, or fungi/mold, is a newcomer to the alternative protein market. It has the advantages of being higher in fiber and lower in fat than meat. When mixed with egg, it creates a meat-like texture with a neutral flavour profile. It faces the challenge of negative perceptions generated by mandatory labelling terminologies such as mold.

Cultured Tissues

Cultured meat is laboratory grown from tissue cells. Currently, this option is not commercially available, but is expected to be available in a few years. While it addresses the animal welfare issue, its complex technology requirements make it an expensive option.

The success of Beyond Meat has exemplified the potential of pea protein products. To learn more about how pea protein and the pulse industry repositioned itself for the growth in protein alternatives, check out https://pearl-strategy.ca/lessons-learned-from-how-pulses-made-a-strategy-pivot/

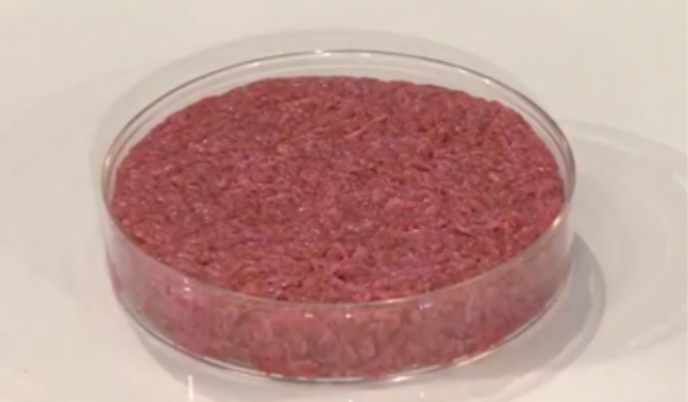

An analysis of Google search trends found that searches for pea protein grew at an annual rate of 30% from 2004 to 2019, while searches for lab-grown or cultured meat increased by 16%.

Below is a chart showing Google search trends of the various proteins interest over time in Canada. Plant based protein has seen the greatest increase in search interest over the past few years, followed by a surge in lab grown meat.

Source: Google Trends, Accessed September 10th 2019

McKinsey predicts that pea protein and cultured meats show the most promise for driving market growth in the coming years. Looking ahead to the future, organizations need to be mindful of emerging narratives about alternative proteins to understand drivers and inhibitors to market growth. The World Economic Forum presented the main supporting and cautionary narratives based on data from Europe and North America.

The top supporting narratives below show that there is demand for high-quality, safe, environmentally friendly products that are sustainable and animal friendly:

- Foods containing alternative proteins help you live a healthier life

- Alternative proteins are free of the risk of food poisoning or contamination

- Products based on alternative proteins taste excellent

- Alternative‐protein products are better for the environment

- Alternative‐protein products do not harm animals

- Alternative proteins promote food security by releasing land currently used to grow animal feed for the production of human food.

The cautionary narratives below highlight the perspectives of traditional protein options and show the need for transparency and education:

- Alternative‐protein products will always play just a minor role in the global food system

- Alternative‐protein products are not real food

- Alternative‐protein products are not as good as the real thing

- Livestock is more than food

Looking forward, it’s anticipated that both meat and alternative-proteins will coexist as the global food system get reshaped with the evolving consumer need for health, sustainability and animal welfare. For alternative protein manufacturers to breakthrough and succeed in this highly competitive market, great tasting food will be table stakes. Those who develop a strong brand proposition and go-to-market model will be well positioned to win this food fight.

Sources:

McKinsey & Company. Alternative proteins: the race for market share is on. 2019.

World Economic Forum. Meat: The Future Series, Alternative Proteins. Jan 2019

Plant-based vs traditional meat: Euromonitor offers four-year outlook. Feb 2019

The Good Food Institute. Plant-Based Market Overview. April 2019.

Pearl’s 2019 Health & Wellness In Canada Report