We attended Dynata’s Global Trend Webinar on April 2, 2020 to hear the latest findings in consumer attitudes and behaviour in response to the COVID-19 pandemic. Below are our key takeaways and implications:

The Economy

Consumer concerns for the economy are increasing, especially at the global level. The report shows they are worried twice as much for the global and domestic economy versus personal. In Canada, over 60% are worried about the global and domestic economies, while less than 40% are worried about their personal household finances.

Implications:

Monitor consumer confidence levels. Declining consumer confidence is a precursor to increased importance in value for money and shift to purchasing more essential items/less non-essential items.

Lifestyle & Purchasing Behaviour

Over the past two weeks, we have seen significant decreases in going out to restaurants/bars, using public transport, and shopping at physical stores. This has been partially offset by slight increases in online shopping and food delivery.

Overall, consumers are shopping less as they postpone their purchases of non-essentials and stay away from physical stores in an effort to practice social distancing. During the week of March 23rd, 47% did not make a non-essential purchase – this is up from about 33% the week before.

Implications:

Communicate how your brands are addressing their essential needs for functional and safety benefits. Once the crisis diminishes, restaurants and physical stores need to help consumers feel comfortable about shifting back to conducting commerce in public spaces.

Health & Healthcare

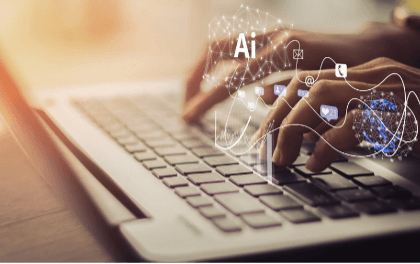

Consumers are increasingly concerned about their personal health and the capacity of the healthcare system. About 60% of Canadians and Americans said they are very worried or extremely worried that their healthcare systems will not be able to cope with the COVID-19 pandemic.

While the elderly and vulnerable segments of the population are more concerned about the capacity of the healthcare system, younger people are more worried about their personal health. Reasons why younger people are over-indexing on personal health concerns include childcare responsibilities, less stable employment, and lower access to healthcare.

A growing majority of people are becoming well informed on how to stop the spread. Top actions include staying home, frequent hand washing, using hand sanitizer, and working from home. During the week of March 16th, over 60% of Canadians said they know how to protect themselves. A week later, this number rose closer to 70%.

Implications:

Stopping the spread of COVID-19 and protecting personal health have become essential functional and safety priorities. Demonstrate how your brands are addressing these needs, either directly or indirectly (i.e. supporting the healthcare system, e-commerce, etc.)

Information Sources & Trust

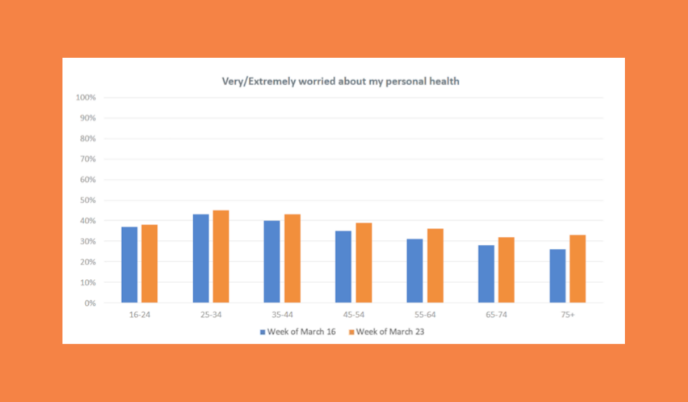

Healthcare professionals are the most trusted source of information, followed by government officials. Only 39% trust the information from brands.

Confidence among Canadians that their government is doing all it can to protect them is increasing. There was a large boost in agreement on that factor between March 16th and March 23rd.

Implications:

Demonstrate empathy for the needs of Canadians and earn their trust by delivering to their essential needs and being transparent.

Society

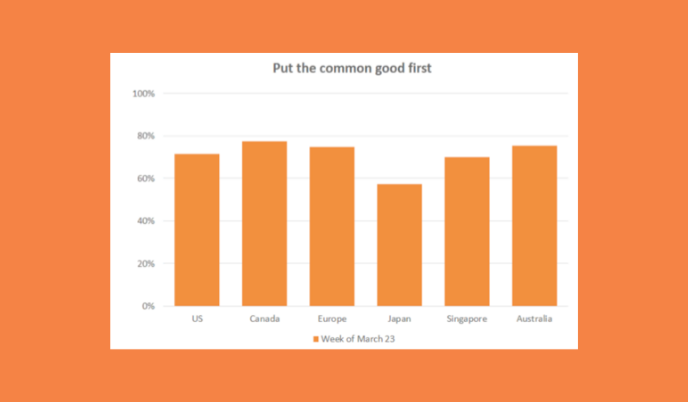

Society is being forced to shift and adapt to COVID-19. Social attitudes and behaviours have undergone major upheaval as people are physically keeping away from others (i.e. no touching strangers, keeping among family and friends). One area of significant concern is isolation of the elderly. Almost 80% of Canadians said we should be putting the common good first ahead of self-interest.

Implications:

Find ways to help people address their need for connection and to support the common good. Think about how your brand can help consumers ease back into an integrated society. Not for profit organizations should tap into the altruism of Canadians as a motivator to support causes that address the needs of society.

When Will It End?

As the reality and magnitude of this crisis settles in, hopes that it will end quickly have decreased across the globe. In Canada during the week of March 23rd, less than 50% were optimistic that it would be over within 3 months. This was a significant shift from the prior week, when that figure was over 50%.

Implications: Continue to track and understand the mindset of your target consumers to align your commercial plans to their needs.

Source & Images from: Lorch, J. Dynata. Global Trends Special Edition: COVID-19 April 2 2020. https://www.dynata.com/global-trends-special-edition-webinar/